sales tax on clothing in buffalo ny

The exemption extends to items used to make or repair exempt clothing and footwear. Buy a coat for 10999 and youll avoid that extra 4 percent.

Authentic Supreme X Akira Yamagata Tee Supreme Shirt Tees Fashion Tees

The recently enacted New York State budget suspended certain taxes on motor fuel and diesel motor fuel effective June 1 2022.

. You can print a 875 sales tax table here. There is no applicable city tax or special tax. Download all New York sales tax rates by zip code.

So you would end up with just the 475 county tax. Sales and Use Tax Rates 512 On Clothing and Footwear Effective June 1 2012 Clothing footwear and items used to make or repair exempt clothing sold for less than 110 per item or pair are exempt from the New York State 4 sales tax the local tax in those localities that provide the exemption and the ⅜ Metropolitan Commuter Transportation. Sales tax applies to retail sales of certain tangible personal property and services.

This is the total of state county and city sales tax rates. 14201 14202 14203. Beginning Sunday clothing and footwear priced under 110 will be exempt from Sales tax break on clothing expanding.

The County sales tax rate is. Back to New York Sales Tax Handbook Top. Sales tax on clothing in buffalo ny - Annalisa Person sales tax on clothing in buffalo ny Monday March 7 2022 That extra penny will add an extra 440 in state sales taxes to.

Irondequoit NY Sales Tax Rate. Any clothing items or pairs of footwear which costs more than 110 dollars is considered to be taxable. Greenburgh NY Sales Tax Rate.

State sales tax doesnt apply to most clothing and footwear sold for human use for less than 110 per item or pair while clothing priced 110 or higher is taxable. East New York NY Sales Tax Rate. For tax rates in other cities see New York sales taxes by city and county.

A change in the law this year. Buffalo is in the following zip codes. Levittown NY Sales Tax Rate.

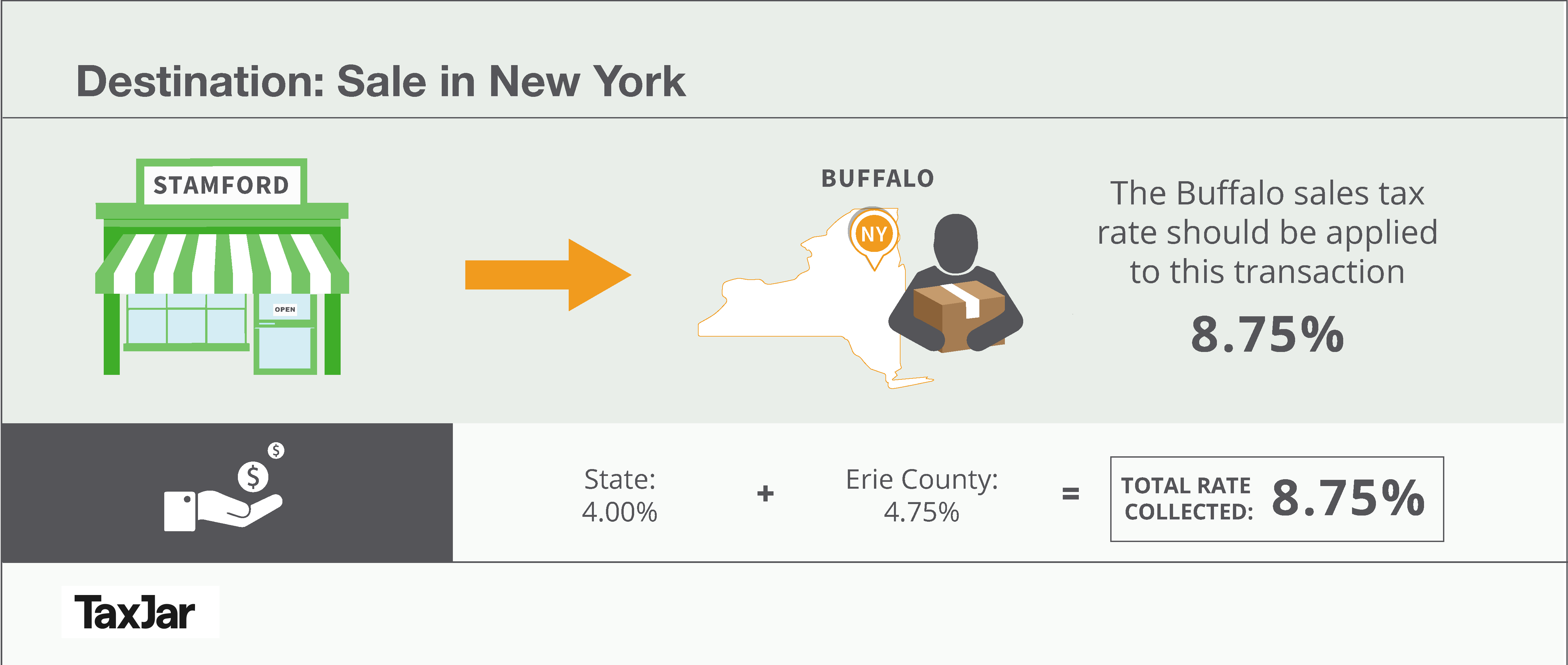

Sales Tax 5 years ago Save 875 If youre clothing total is under 110 I believe the 4 NYS tax is waived. Buffalo NY Sales Tax Rate Buffalo NY Sales Tax Rate The current total local sales tax rate in Buffalo NY is 8750. That extra penny will add an extra 440 in state sales taxes to.

The December 2020 total local sales tax rate was also 8750. The Erie County New York sales tax is 875 consisting of 400 New York state sales tax and 475 Erie County local sales taxesThe local sales tax consists of a 475 county sales tax. Buffalo New York Level Contributor 107 posts 34 reviews 24 helpful votes 1.

See reviews photos directions phone numbers and more for Sales Tax locations in Buffalo NY. State sales tax also doesnt apply to the following. Sales Tax Breakdown Buffalo Details Buffalo NY is in Erie County.

Did South Dakota v. Subscribe to Sales tax to receive emails as we issue guidance. Jamaica NY Sales Tax Rate.

Buffalo NY Sales Tax Rate. The 875 sales tax rate in Buffalo consists of 4 New York state sales tax and 475 Erie County sales tax. The latest sales tax rate for Brooklyn NY.

Wayfair Inc affect New York. Clothing footwear and items used to make or repair exempt clothing sold for less than 110 per item or pair are exempt from the New York State 4 sales tax the local tax in localities that provide the exemption and the ⅜ Metropolitan Commuter Transportation District MCTD tax within exempt localities in the MCTD. State sales tax doesnt apply to most clothing and footwear sold for human use for less than 110 per item or pair while clothing priced 110 or higher is taxable.

Athletic equipment and protective devices. 2020 rates included for use while preparing your income tax deduction. Use tax applies if you buy tangible personal property and services.

By Mark ScottBuffalo NY There will be no sales tax free week on clothing purchases for back-to-school shoppers this year. In the state of New York the clothing exemption is limited specifically to footwear and clothing which costs no more than 110 dollars for each item or pair. Clothing footwear and things utilized to create or repair absolved clothing sold for less than 110 per thing or combine are excluded from the New York State 4 sales tax the neighborhood charge in territories that give the exception and the ⅜ Metropolitan Commuter Transportation Locale MCTD tax inside excluded territories within the MCTD.

Report inappropriate content dreamer_in_dreamer Halifax Canada Level Contributor 178 posts 102 reviews. The Erie County Sales Tax is collected by the merchant on all qualifying sales made within Erie County. Clothing and footwear sold for less than 110 per item or pair and items used to make or repair this clothing are exempt from the New York State 4 sales and use taxes.

See reviews photos directions phone numbers and more for Sales Tax Office locations in Buffalo NY. Hempstead NY Sales Tax Rate. The New York sales tax rate is currently.

Cheektowaga NY Sales Tax Rate. Coney Island NY Sales Tax Rate. Sales and Use Tax Rates on Clothing and Footwear Effective March 1 2022 Clothing footwear and items used to make or repair exempt clothing sold for less than 110 per item or pair are exempt from the New York State 4 sales tax the local tax in those localities that provide the exemption and the ⅜ Metropolitan Commuter.

The minimum combined 2022 sales tax rate for Buffalo New York is. The Buffalo sales tax rate is. The exemption does not apply to local sales and use taxes unless the county or city imposing the taxes elects to provide the exemption.

This rate includes any state county city and local sales taxes. While dropping the county sales tax on clothing and footwear would save shoppers money it would cost the Village of Williamsville nearly 21000 in.

Which States Require Sales Tax On Clothing Taxjar

How To Charge Your Customers The Correct Sales Tax Rates

Buffalo Bills Fan Style Inspiration Bills Fashion Inspiration Buffalo Bills Buffalo Bills Stuff Buffalo Bills Outfit

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

The New York Clothing Sales Tax Exemption Demystified Taxjar

1865 Cdv Photo Full Standing Lady Dress Civil War Tax Revenue Stamp Baltimore 57 Civil War Era Sales Image Civil War Dress

Da Bills Buffalo Bills Football Buffalo Bills Stuff Buffalo Bills

Clothing Resale Popular With Retailers Now That It S Cool Profitable

New York Sales Tax For Photographers Bastian Accounting For Photographers

Crazy Bills Lady Buffalo Bills Baby Buffalo Bills Football Buffalo Bills

Vintage Canape Knife Wood Block Mail Order Sample Cheese Butter Spreader Butter Spreader Wood Blocks Canapes

Orig 1864 Cdv Of Native American Woman Iroquois Seneca Tribe Civil War Tax Stamp Native American History Native American Women Native American Clothing

Buffalo Sabres Nhl Banana Slug Ryan Miller 30 Jersey Reebok Blue Strapback Hat In 2022 Reebok Strapback Hats Buffalo Sabres

Berger S Berger Motts Contrast

Memorial Day Sales Event Ad Is Officially Out Redwingchevrolet Grills From Red Wing Ace Hardware Hanisch Bakery Gift C Memorial Day Sales Chevrolet Red Wings

Mix No 6 Women S Buffalo Plaid Triangle Blanket Scarf Casual Outfits For Moms Women S Buffalo Plaid Business Casual Dresses

80s Bracelets Jelly Bracelets Nostalgia Funny Ads

The New York Clothing Sales Tax Exemption Demystified Taxjar

How To Avoid New York Sales Taxes At The Mall Newyorkupstate Com